Investors

About Klépierre

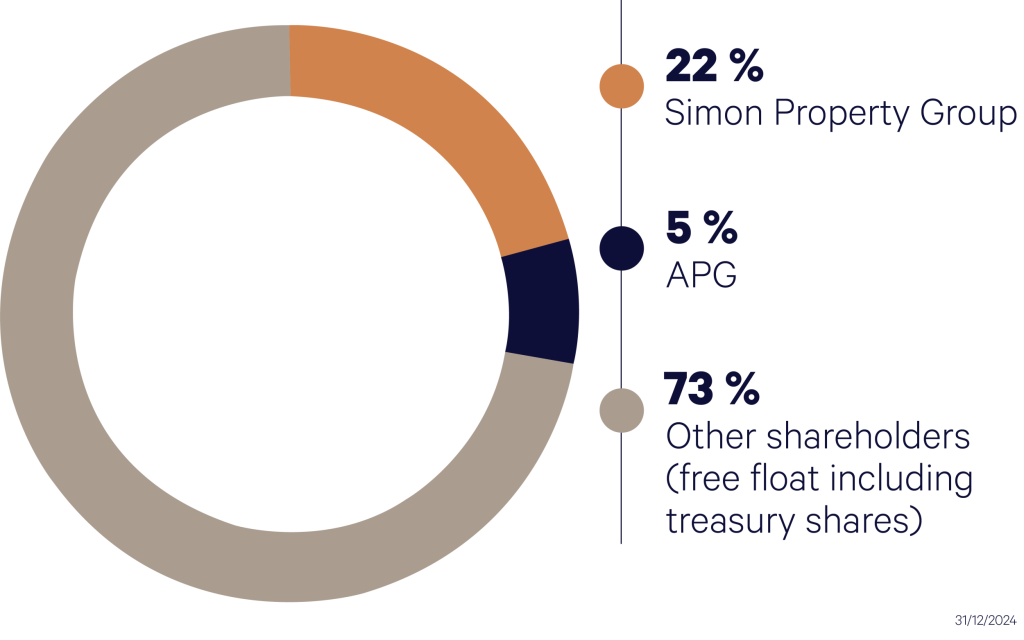

Shareholder base

Simon Property Group, the US-based real estate investment trust mainly engaged in the ownership of prime shopping centers worldwide is Klépierre’s reference shareholder with more than 22% of shareholding. APG, the largest pension administrator in the Netherlands holds 5% of the shareholding.

Stock Market Data

Share price

Source : Euronext

This stock price is provided exclusively for information and not for trading purposes. Before any transaction, please contact your broker. Klépierre or Interactive Data Managed Solutions cannot be held responsible for inaccurate, delayed or interrupted data, regarding the stock price announced on Klépierre website.

Information Sheet and key figures

In detail

Data as of December 31, 2024

Klépierre share in figures

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Average number of shares |

199,470,340 |

314,356,063 |

311,736,861 (1) |

306,084,849 |

299,913,706 |

293,941,863 |

286,072,515 |

285,860,024 |

286,524,518 |

286,861,172 |

286,861,172 |

Market capitalization (millions of euros) (2) |

7,127 |

12,885 |

11,740 |

11,526 |

8,475 |

10,245 |

5,516 |

5,981 |

6,176 |

7,080 |

7,975 |

Volume traded (daily average) |

225,430 |

719,370 |

622,113 |

654,615 |

718,289 |

726,782 |

1,456,093 |

1,089,183 |

974,916 |

791,834 |

633,625 |

(1) Further to the Corio acquisition, the number of shares takes into account the creation of 96 589 672 new shares on January 8, 2015, 10 976 874 new shares on January 15, 2015 and 7 319 177 new shares in March 2015.

(2) Last cotation of the year.

EPRA PERFORMANCE INDICATORS

The following performance indicators have been prepared in accordance with best practices as defined by EPRA (European Public Real Estate Association) in its Best Practices Recommendations guide, available on EPRA’s website (www.epra.com).

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|

EPRA Earnings (in millions of euros) |

694.4 |

732.4 |

767.3 |

814.2 |

583.7 |

610.4 |

729.1 |

697.2 |

748.3 |

EPRA Earnings per share (in euros) |

2.23 |

2.39 |

2.56 |

2.77 |

2.04 |

2.14 |

2.54 |

2.44 |

2.61 |

EPRA NRV (in millions of euros) |

_ |

_ |

_ |

11,978 |

10,184 |

10,034 |

9,936 |

9,664 |

10,512 |

EPRA NRV per share (in euros) |

_ |

_ |

_ |

41.5 |

35.7 |

35.1 |

34.7 |

33.7 |

36.7 |

EPRA NTA (in millions of euros) |

_ |

_ |

_ |

10,643 |

8,957 |

8,913 |

8,848 |

8,621 |

9,397 |

EPRA NTA per share (in euros) |

_ |

_ |

_ |

41.5 |

35.7 |

31.2 |

30.9 |

30.1 |

32.8 |

EPRA NDV (in millions of euros) |

_ |

_ |

_ |

8,920 |

7,300 |

7,741 |

8,580 |

7,931 |

8,408 |

EPRA NDV per share (in euros) |

_ |

_ |

_ |

30.9 |

25.6 |

27.1 |

29.9 |

27.7 |

29.3 |

“TOPPED-UP” NET INITIAL YIELD shopping centers |

5.1% |

4.9% |

5.1% |

5.2% |

5.6% |

5.4% |

5.7% |

6.1% |

6.0% |

NET INITIAL YIELD shopping centers |

4.9% |

4.8% |

4.9% |

5.0% |

5.3% |

5.2% |

5.4% |

5.9% |

5.9% |

EPRA Vacancy rate |

3.5% |

3.2% |

3.2% |

3.0% |

4.8% |

5.3% |

4.2% |

4.0% |

3.5% |

Cost Ratio (including vacancy costs) |

18.7% |

17.9% |

17.2% |

15.4% |

26.1% |

19.9% |

18.2% |

20.3% |

18.8% |

Cost Ratio (excluding vacancy costs) |

16.3% |

16.3% |

15.6% |

13.9% |

24.3% |

17.5% |

16.1% |

17.6% |

16.5% |

EPRA Capital Expenditure (in millions of euros) |

_ |

_ |

407.7 |

302.7 |

181.3 |

169.6 |

184.1 |

199.2 |

418.5 |

EPRA Loan-to-Value Ratio (excluding real estate transfer taxes) |

_ |

_ |

_ |

_ |

_ |

_ |

43.7% |

44.1% |

43.2% |

EPRA Loan-to-Value Ratio (including real estate transfer taxes) |

_ |

_ |

_ |

_ |

_ |

_ |

41.6% |

42.1% |

41.1% |

EPRA Earnings: EPRA Earnings is a measure of the underlying operating performance of an investment property company excluding fair value gains, investment property disposals and limited other items that are not considered to be part of the core activity of an investment property company.

EPRA Net Reinvestment Value (NRV): EPRA NRV aims to highlight the value of net assets on a long-term basis and to represent the value required to rebuild the entity assuming that no selling of assets takes place.

EPRA Net Tangible Asset Value (NTA): EPRA NTA reflects tangible assets only and assumes that companies buy and sell some of their assets, thereby crystallizing certain levels of unavoidable deferred tax liability and RETT. By definition, EPRA NTA aims at valuing solely tangible assets and therefore, as regards Klépierre, does not incorporate the fair value of management services companies (unlike the former indicators EPRA NAV and NNNAV).

EPRA Net Disposal Value (NDV): EPRA NDV aims to represent the shareholders’ value under an orderly sale of the business, where RETT, deferred taxes, financial instruments and certain other adjustments are calculated to the full extent of their liability while discarding completely any RETT or tax optimization. Intangible assets are also excluded from this methodology.

EPRA Net Initial Yield and EPRA “Topped-up” Net Initial Yield: EPRA NIY (Net Initial Yield) is calculated as the annualized rental income based on the cash rents passing at the balance sheet date (but adjusted as set out below), less non-recoverable property operating expenses, divided by the gross market value of the property. EPRA “Topped-up” NIY is calculated by making an adjustment to EPRA NIY in respect of the expiration of rent free periods (or other unexpired lease incentives such as discounted rent free periods and step rents).

EPRA Vacancy rate: The EPRA Vacancy rate is calculated by dividing the market rents of vacant spaces by the market rents of the total space of the whole property portfolio (including vacant spaces).

EPRA Cost ratio: The purpose of the EPRA cost ratio is to reflect the relevant overhead and operating costs of the business. It is calculated by expressing the sum of property expenses (net of service charge recoveries and third-party asset management fees) and administration expenses (excluding exceptional items) as a percentage of gross rental income.

(1) The EPRA cost ratio for 2016 and 2017 has been restated to reflect service charges recovered through rents which have been reclassified in accordance with EPRA guidelines.

Share price (in euros)

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Highest |

37.76 |

47.69 |

43.17 |

38.13 |

37.32 |

33.85 |

34.66 |

25.76 |

26.37 |

25.09 |

30.28 |

Lowest |

31.09 |

35.29 |

34.56 |

32.24 |

26.5 |

26.53 |

10.21 |

16.53 |

17.34 |

19.7 |

22.69 |

Close |

35.73 |

40.99 |

37.35 |

36.67 |

26.96 |

33.85 |

18.39 |

20.85 |

21.53 |

24.68 |

27.8 |

General meeting

Analysts

Analysts covering klépierre by company

| Company | Analyst |

|---|---|

BARCLAYS |

Céline Soo-Huynh |

BofA SECURITIES |

Markus Kulessa |

BERENBERG |

Kai Klose |

CITI |

Aaron Guy |

DEGROOF PETERCAM |

Amal Aboulkhouatem |

DEUTSCHE BANK |

Thomas Rothaeusler |

EXANE |

Samuel King |

GOLDMAN SACHS |

Jonathan Kownator |

GREEN STREET ADVISORS |

Rob Virdee |

HSBC |

Thomas Martin |

INVEST SECURITIES |

Bruno Duclos |

JEFFERIES |

Pierre-Emmanuel Clouard |

JP MORGAN |

Vanessa Guy |

KEPLER CHEUVREUX |

Frédéric Renard |

KEMPEN |

Véronique Meertens |

MORGAN STANLEY |

Bart Gysens |

ODDO BHF SECURITIES |

Florent Laroche-Joubert |

SOCIÉTÉ GÉNÉRALE |

Valérie Jacob |

UBS |

Charles Boissier |

Become shareholders

Investor relations contact

investorrelations@klepierre.com

+33 (0)7 50 66 05 63

+33 (0)7 72 09 29 57

Contact for holders of registered shares

www.sharinbox.societegenerale.com

+33 825 315 315: information on General Meeting

+33 2 51 85 67 89: Nomilia, Centre de Relation Client (from 08:30 to 18:00 from Monday to Friday)

—

Société Générale Securities Services

32 rue du Champ de Tir – CS 30812

44308 NANTES cedex 3

FRANCE

To become holder of registered shares

To become holder of registered shares, you must acquire bearer shares and then download the following form and send it to your financial intermediary, which will take the necessary steps with Société Générale Securities Services.

Download the application form to become holder of registered shares.